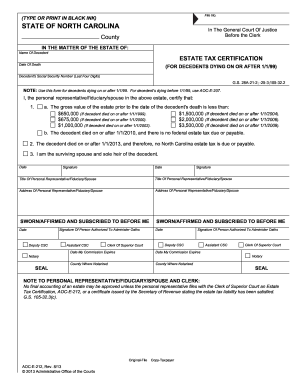

north carolina estate tax certification

Estate Tax Certification For Decedents Dying On Or After 1 1 99. Tax Certification Program North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery.

North Carolina Gift Tax All You Need To Know Smartasset

In addition applicants must demonstrate involvement in specific estate planning activities as defined below.

. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws. The North Carolina General Assembly. Tax Certification Alleghany County North Carolina Tax Certification NOTICE.

PERS - Certified Personal Property Appraiser REAL -. I counseled persons in estate planning including giving advice with respect to. Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form.

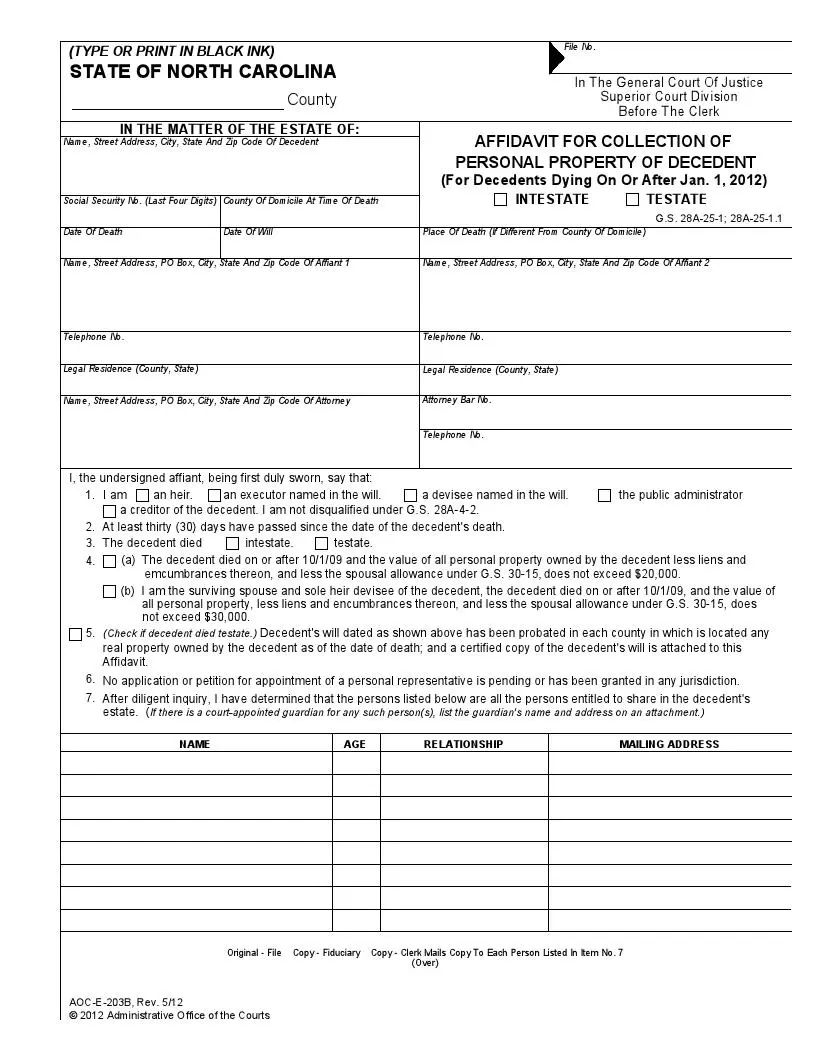

This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws. A tax certification form must accompany ALL DEEDS to be recorded. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99.

To be a certified assessor the provisions of NCGS 105-294 must be met. RPT is 2 in the Metro Manila region. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property.

1 military retirees who settle in North Carolina will no longer be subject to state taxes on their pensions. Real estate taxes are calculated by multiplying RPT by the assessed value of the property. It is first advisable that any.

Estate Tax Certification For Decedents Dying On Or After 1199. How To Compute Your Real Estate Tax. Type of certification also indicates the following.

North Carolina law requires the Department of. Winston-Salem is one of the best places to live in North Carolina for families as the metro area has affordable housing and a low cost of living. For assistance or to acquire a copy of the.

For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. Inheritance And Estate Tax Certification North Carolina Judicial Branch Home Documents Forms Inheritance And Estate Tax Certification AOC-E-207 Estate E Inheritance. Estate Tax Certification For.

Free North Carolina Small Estate Affidavit Form Pdf Formspal

Death And Taxes The Public Finance Blog You Can T Avoid

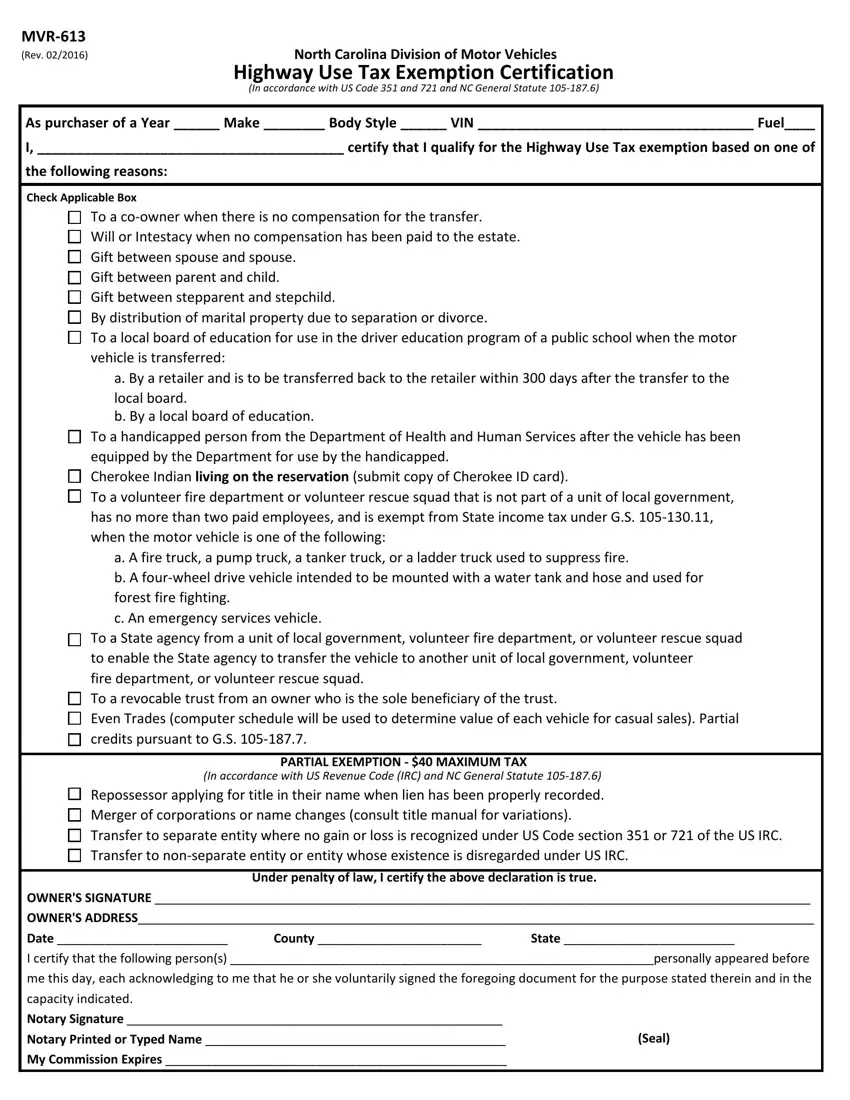

Mvr 613 Form Fill Out Printable Pdf Forms Online

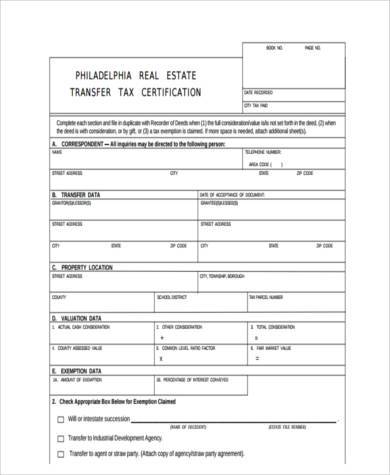

Free 10 Sample Real Estate Tax Forms In Pdf Excel

Tax Listings Personal Property Dare County Nc

Multistate Tax Commission News

Guilford County Tax Department Guilford County Nc

Certified Financial Planner North Carolina State University

Moved South But Still Taxed Up North

Tax Rockingham County North Carolina

North Carolina Issues Guidance On Pass Through Entity Tax Cherry Bekaert

Dare County Tax Department Dare County Nc

Death And Taxes The Public Finance Blog You Can T Avoid

Guilford County Tax Department Guilford County Nc

North Carolina Archives Page 3 Of 8 Pdfsimpli

Aoc E 212 Form Fill Out And Sign Printable Pdf Template Signnow