tax abatement definition for dummies

The IRS grants abatement or tax relief only to taxpayers who have proven reasonable causes behind a penalty despite tax trouble. An exemption reduces the taxable value of a property which in turn lowers the taxes owed.

An abatement is a reduction in a tax rate or tax liability.

. Property taxes are a common subject of abatement though the term is often used when discussing overdue debt. Some organizations offer tax abatement on the properties. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would.

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. An abatement reduces the taxes directly for a specific period of time. Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis.

What Does Tax Abatement Mean. More from HR Block. They could be in the form of a rebate reduction in tax penalties or an actual tax decrease.

The IRS requires that all taxpayers file and pay their taxes on time each year. It can be for either individual consumers or companies. Without tax abatement I will never get the loans to finance the project.

That said the same owner may qualify for a tax exemption on one property and not on another. Some cities introduce property tax abatement to homeowners. Abatement of tax refers to a reduction in or reprieve from a tax debt or any other payment obligation.

A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment. Tax Penalty Abatement. Such arrangements are known as tax abatements.

A tax abatement package programme. Governments sometimes introduce it to encourage economic development. For example John Doe owns a house and owes 4000 in property taxes for the year.

IRS Definition of IRS Penalty Abatement. Johns house is very old and he is able to have it. An amount by which a tax is reduced.

These organizations include municipalities state treasury offices city governments and the federal government. A taxpayer seeking abatement of taxes assessed on property has the burden of proving the disproportionate payment of taxes by a preponderance of the evidence. The First-Time Tax Penalty Abatement exists to help otherwise compliant taxpayers avoid these fines and punishments.

A sales tax holiday is another instance of tax abatement. The primary purpose for this new requirement is to provide. It is offered by entities that impose taxes on property owners.

It reduces or completely eliminates the tax on the commercial or residential property. The term abatement refers to a situation where an economic burden is reduced. The difference between a tax abatement and a tax assessment.

The difference is fairly simple. Penalty abatement removal is available for certain penalties under certain circumstances. You can make use of this program by.

77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. This period is typically extended to between 5 and 10 years. Also known as a tax holiday it is the temporary elimination or reduction of tax.

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. A temporary suspension of property taxation generally for a spe-cific period of time. Who Receives a Tax Abatement.

The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax. A reduction of taxes for a certain period or in exchange for conducting a certain task. An abatement is a tax break offered by a state or municipality on certain types of real estate or business opportunities.

Recently the GASB published GASB Statement No. Tax abatement is a kind of relief the IRS grants to taxpayers who exert effort to comply with the law but are unable to fulfill their tax obligations because of uncontrollable events. Tax abatements help reduce the initial costs of opening a business.

How Does an Abatement Work. Definition of tax abatement. For example a tax abatement may be given to a developer or building owner who builds or.

There are many examples of this type of tax break. Governments use abatements as an economic development tool. Sometimes people or firms pay too many taxes or get a tax bill that is higher than it should be.

This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. What is an Abatement.

An abatement may occur after a natural disaster such as a devastating earthquake flood or hurricane. Tax abatements are the most frequent scenarios where the term is employed and they are a reduction or exemption. The development is eligible for a 10-year property tax abatement.

Tax abatement is a financial incentive for the buyer. A city grants a tax abatement to a developer. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

For those individuals who are unable or failed to comply they can expect to have penalties levied against them. A penalty or tax abatement can be defined as forgiveness of the penalties associated with tax debt that have been added on by the IRS over the course of the debt. Tax abatement represents a taxation level reduction.

They are granted by the city and can provide full or partial relief from property and other taxes for a specified period of time.

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

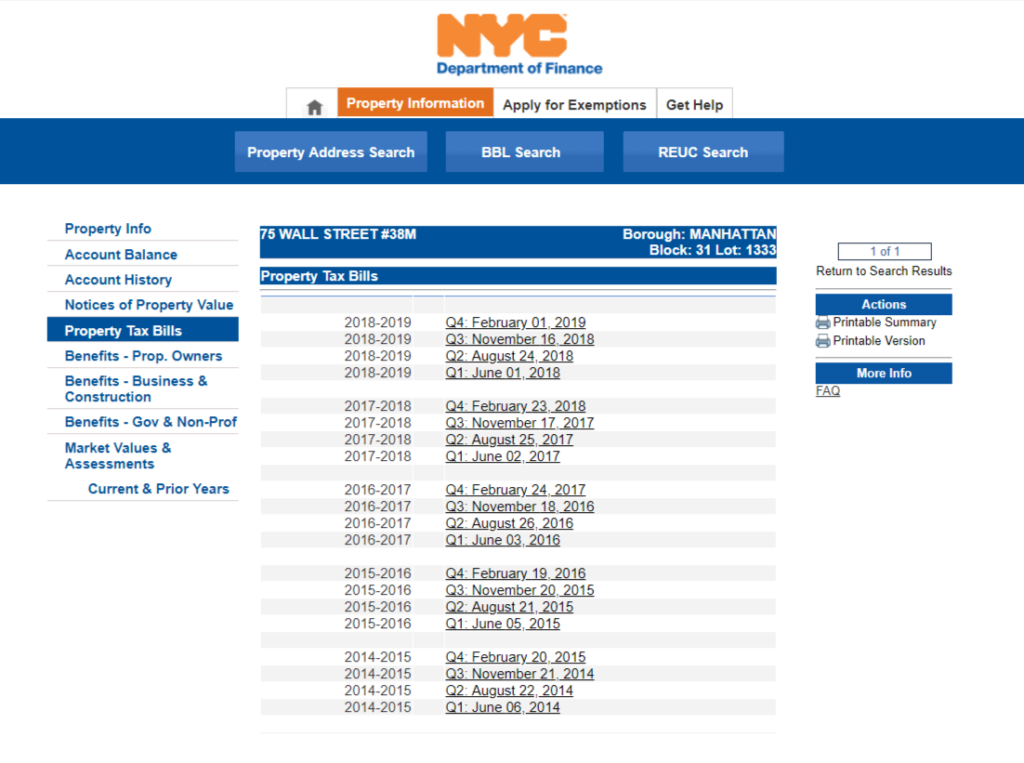

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

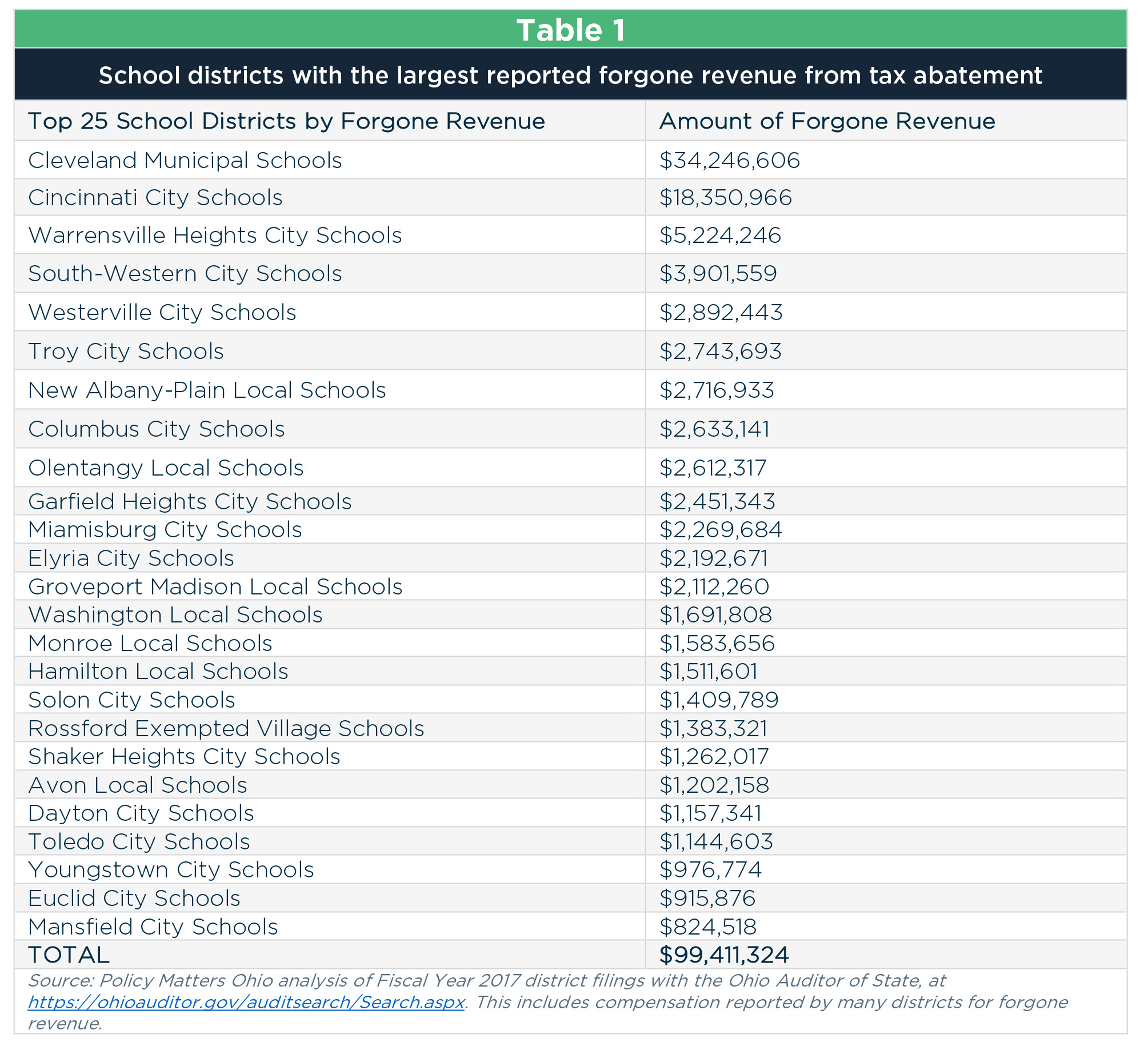

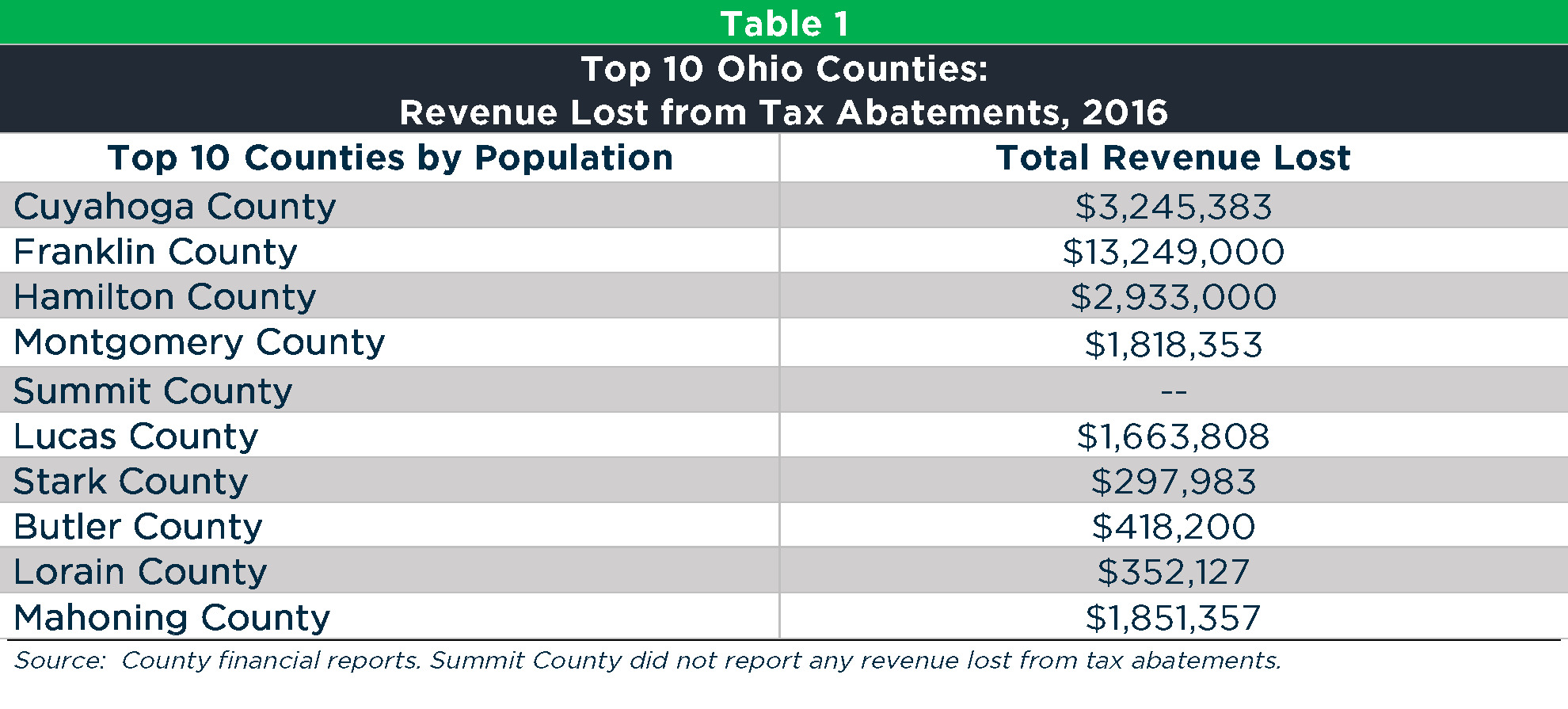

Tax Abatements Cost Ohio Schools At Least 125 Million

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

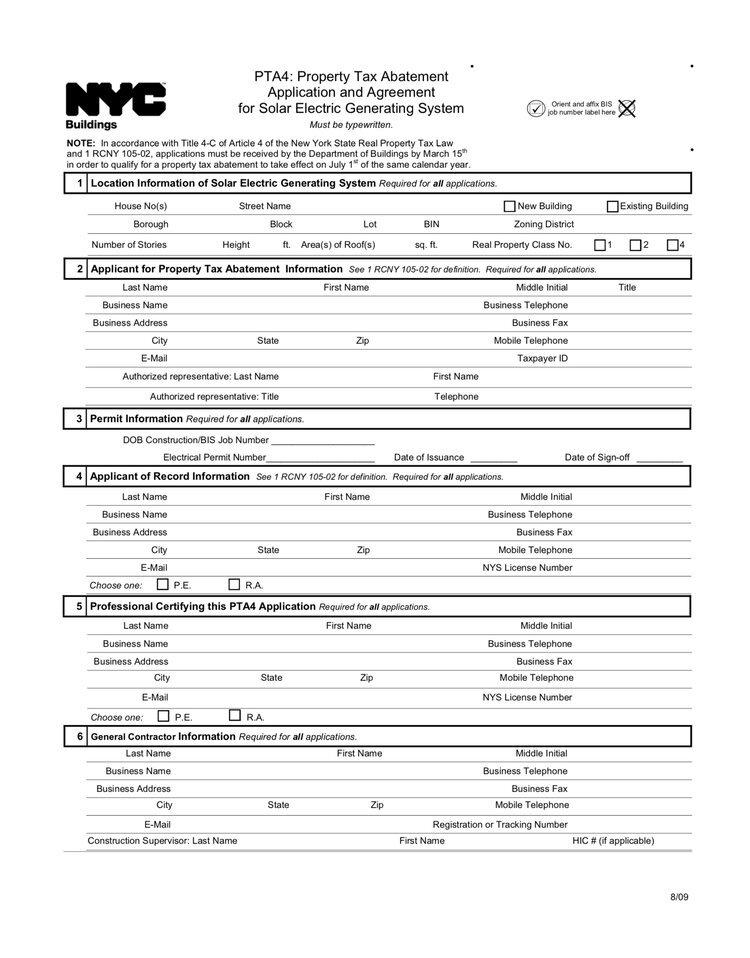

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Tax Abatements 101 A Basic Overview Civic Parent

What Is Abatement Definition And Examples Market Business News

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Local Tax Abatement In Ohio A Flash Of Transparency

What Is The 421g Tax Abatement In Nyc Hauseit